Here’s the reality: Clio’s 2023 Legal Trends Report shows lawyers are losing up to 30% of billable hours just because of inaccurate legal billing. That’s a massive hit to the bottom line.

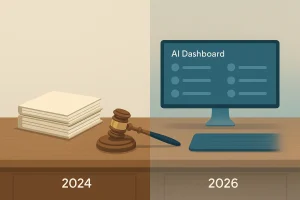

Far too many Indian law firms are still relying on old-school methods, Excel spreadsheets, handwritten notes, or a disconnected platform. The result? Chaos, inefficiency, and, frankly, money down the drain.

These legal billing mistakes aren’t just a minor inconvenience. They can have serious impact costing attorneys up to 50% of their revenue. That’s not just a rounding error; it’s a massive leak.

So, what’s the smart move? Invest in intelligent, integrated legal billing software like LegalWize by Image Computers. This type of platform automates, standardizes, and streamlines everything from timesheets to trust accounting, so your team can focus more on clients and less on paperwork.

In this blog, we’ll break down the most common legal billing mistakes and show how the right technology can solve them, keeping your firm profitable and compliant.

Why Is Legal Billing So Complicated?

Legal billing is a complex process because it involves much more than just tracking time. Lawyers often handle tasks that don’t fit neatly into categories, making it hard to record billable hours accurately. Each law firm must also deal with different client preferences—hourly rates, flat fees, contingency models, or blended rates. Managing these customized billing structures adds another layer of complexity.

Another challenge is staying compliant with legal and ethical rules. Firms must follow strict guidelines around billing transparency, client confidentiality, and regulatory requirements like fee agreements and conflicts of interest.

1. Inconsistent Timekeeping

In the legal billing process, too many attorneys just jot down their billable hours at the end of the week, or worse, at month’s end, and trust their memory. That’s risky business. This habit almost guarantees missed hours, which means lost revenue and headaches down the line.

The cost? Lost billable time hits your bottom line directly, and clients start questioning the accuracy of their invoices. Not exactly the image you’re aiming for.

What’s the fix? Invest in robust legal billing software. Choose platforms with built-in timers and mobile apps, so you can record time the moment you’re working—whether you’re at your desk or out at court. Tools like LegalWize seamlessly connect your entries to specific matters and task codes, making billing more precise, transparent, and, honestly, a lot less of a hassle.

2. Vague or Incomplete Descriptions

Mistake: Incomplete or absurd legal billing entries are often difficult to justify. One word billing descriptions like “Legal work” or “Consultation” don’t provide clients with enough context, leading to disputes or delayed payments.

Impact: A 2024 survey by Bar & Bench India found that 22% of corporate clients in India have challenged invoices over vague line items or non-itemized charges.

Solution: Legal billing software ensures standardized billing narratives using pre-configured templates. Many tools also integrate with matter management systems to auto-fill relevant details—reducing ambiguity and increasing client confidence.

3. Overlooking client-specific billing rules

Some Indian law firms and lawyers still ignore or overlook the intricate legal billing requirements their corporate clients set—whether that means not billing for intern hours, sticking to project time caps, or providing detailed, matter-level itemization. When firms overlook these instructions, invoices get stuck in limbo or bounce back unpaid. Not exactly great for cash flow.

According to the 2024 India Business Law Journal Billing Rates Survey, general counsel at leading Indian firms is tired of inflexible billing and vague invoice descriptions. In-house legal teams now expect strict adherence to custom billing policies and e-billing systems.

With LegalWize’s rule-based billing engine, firms can effortlessly configure client-specific billing rules—like excluding certain timekeepers, applying caps, or tagging task codes. Once set, these rules auto-apply at invoice generation, reducing rejection rates and easing compliance workflows.

4. Missing Deadlines for Invoicing

“Delayed invoicing affects not just revenue, but also the trust we build with corporate clients. They expect timeliness as much as accuracy,” said Adv. Desai, Managing Partner at a mid-sized Mumbai law firm. Invoices issued late create cash flow gaps and strain client relationships.

This issue will be resolved with our legal billing software LegalWize. With Automated reminders, recurring billing schedules, and pre-scheduled invoice dispatch, LegalWize ensures that your firm maintains a consistent billing rhythm. These smart workflows reduce manual follow-up and help preserve your firm’s cash flow and credibility.

5. Non-Compliance with Audit and Tax Standards

Plenty of law firms fail when it comes to keeping their legal billing records audit-ready. GST, TDS, and managing client trust accounts-It’s a lot to juggle, and things can easily slip through the cracks if not taken care of. The risks are real—CAclubIndia points out that sloppy tax documentation and not separating client funds have landed firms in difficult situations like sparking audits and hefty penalties.

How LegalWize can help?

LegalWize’s audit-ready billing architecture includes GST-compliant invoice templates, automated tax calculations, and built-in trust account management with role-based access controls. The platform ensures your firm meets audit expectations while reducing the risk of financial or reputational damage.

6. Manual Calculations & Double Data Entry

Mistake: Many law firms manually enter time, expenses, and tax details into invoices—raising the risk of human error and inefficiency.

Integrated legal billing software LegalWize automates tax calculations (like GST), applies rate cards, and syncs data with accounting platforms (e.g., QuickBooks, Tally). It removes redundancy, improves accuracy, and reduces invoice preparation time.

Final Thoughts

Billing mistakes may seem small, but over time they can affect the client trust, delay payments, and hurt your law firm’s profitability and credibility. Whether it’s missed billable hours, vague invoice descriptions, or non-compliance with client billing rules—these challenges are all too common in the legal industry.

But the good news is, they’re avoidable.

With the right tools in place, like LegalWize, your firm can bring accuracy, consistency, and transparency to every invoice. From real-time timesheet tracking and automated GST-ready invoicing to trust accounting compliance and custom rule enforcement, LegalWize is built to handle the unique billing needs of modern law firms of any size.

Book a free demo of LegalWize today and see how it can help your firm streamline billing, stay compliant, and get paid faster—without the stress.